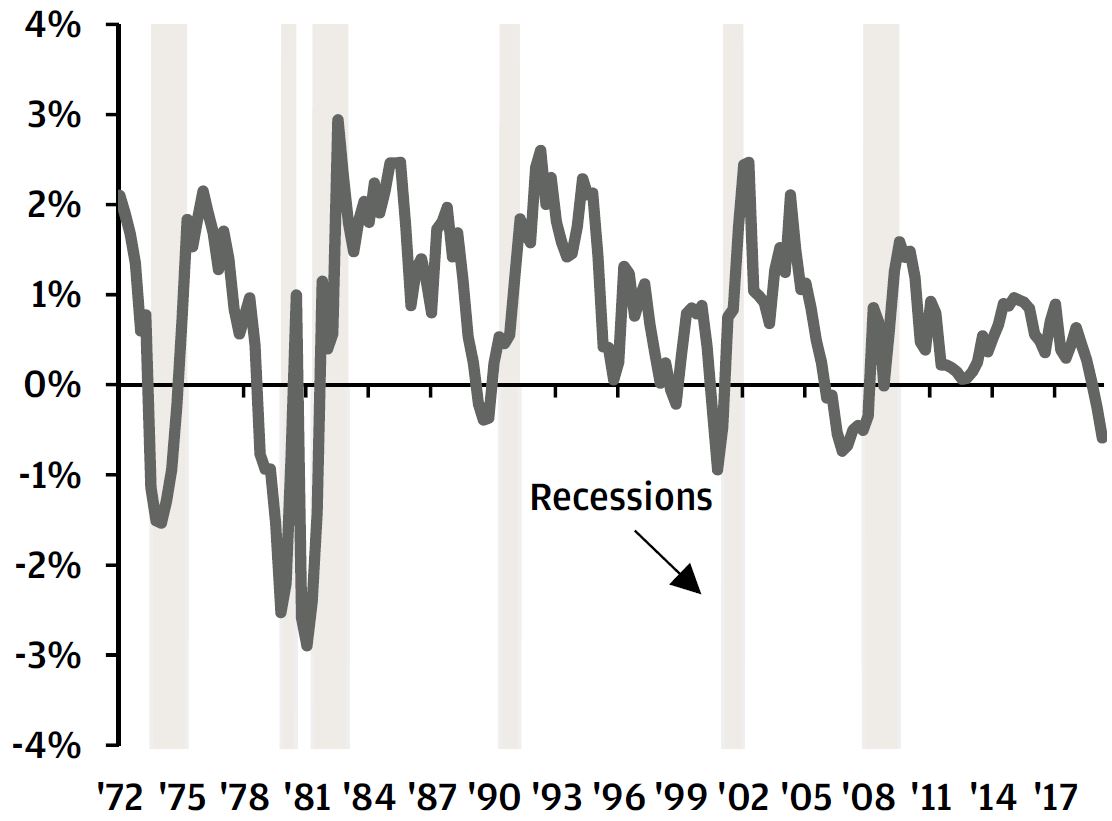

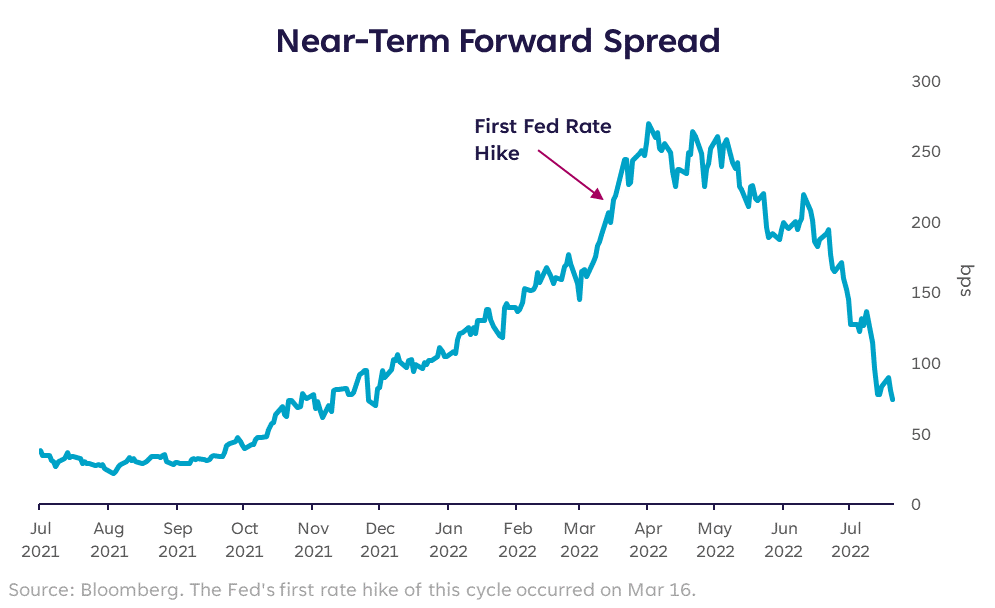

This Reliable Economic Indicator Is Still Flashing Green – Frank Hawkins Kenan Institute of Private Enterprise

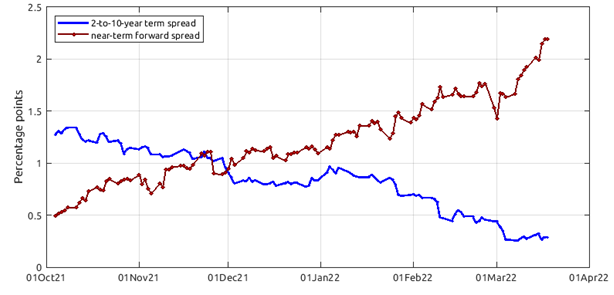

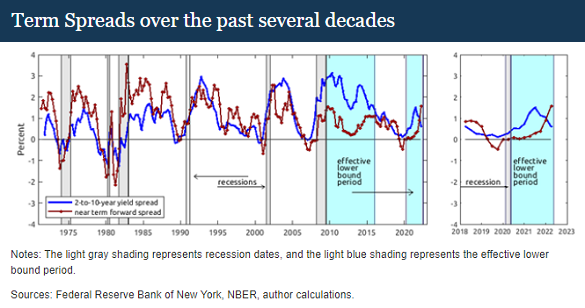

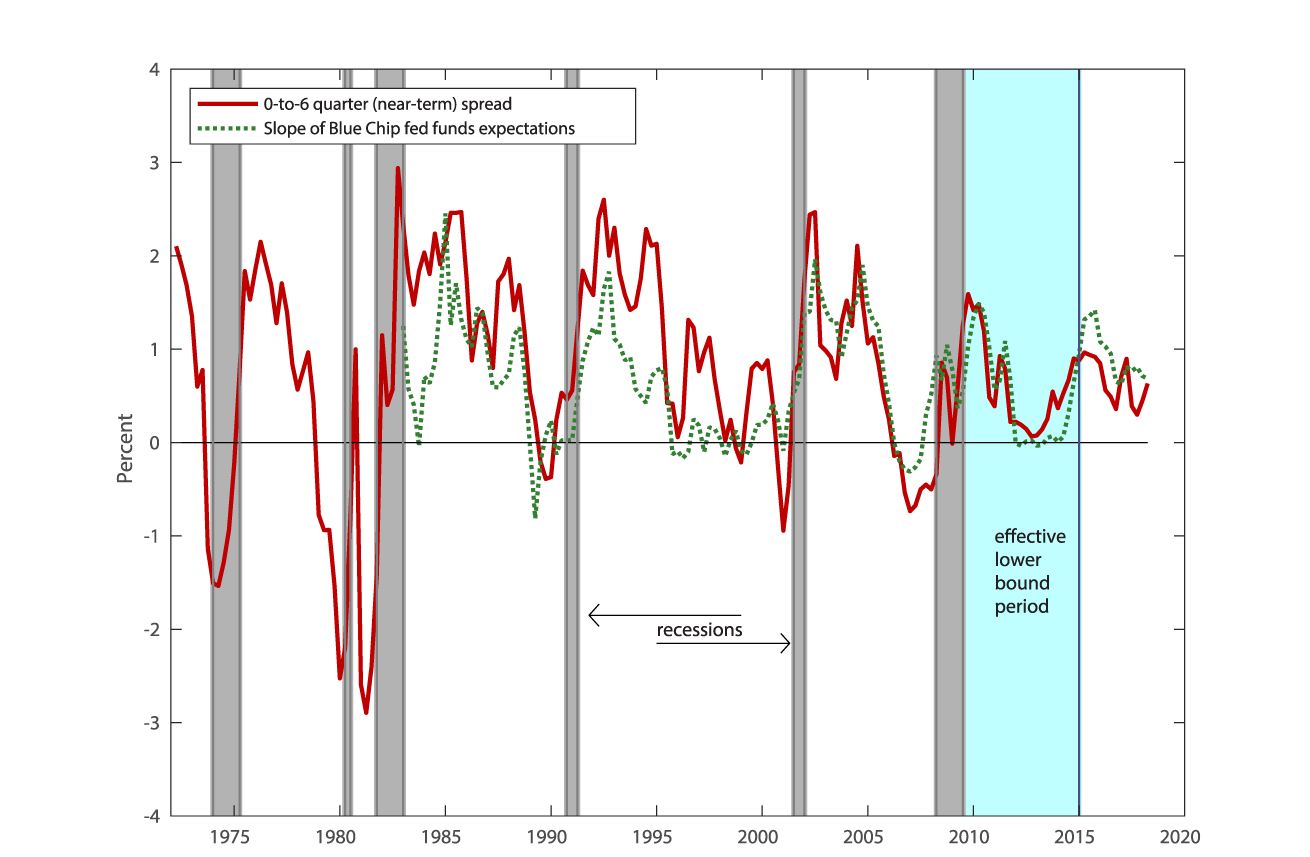

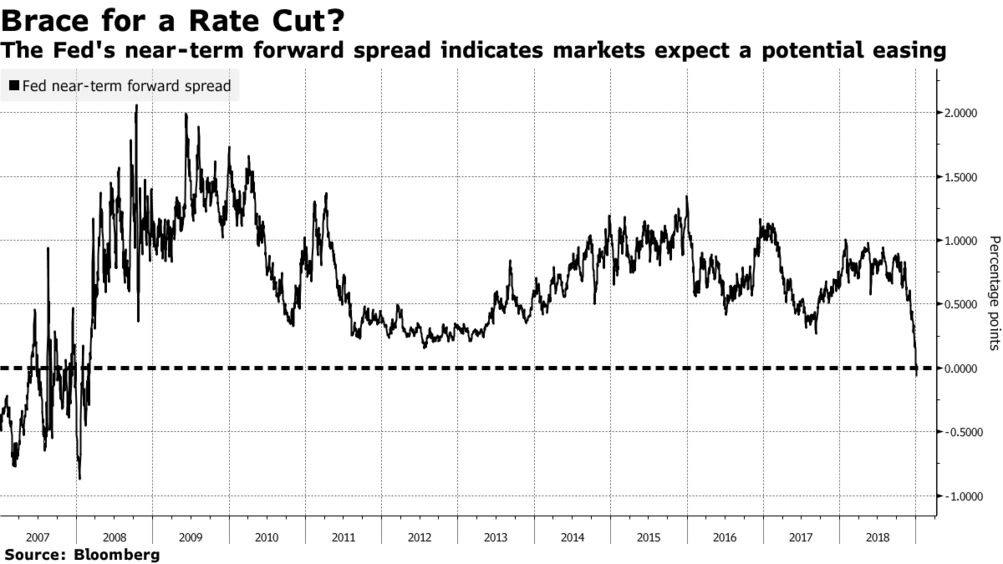

Martin Enlund ⚡️🦆🚁 on Twitter: "🤓$USD: Inversions of the ED$ curve/near-term forward spread historically predicts #Fed easing cycles. ED10 vs ED6 "predicts" the #Fed will cut rates by 200bp/annum in a few

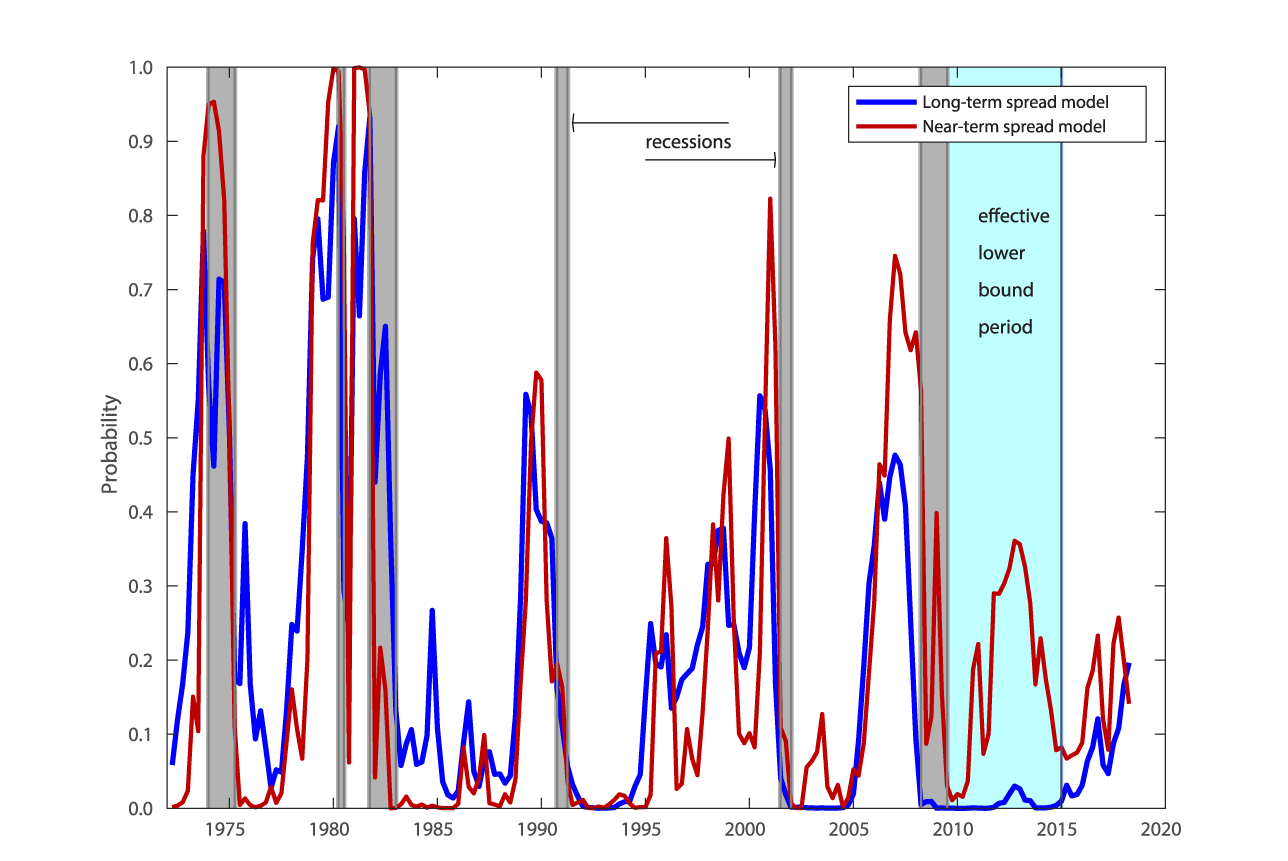

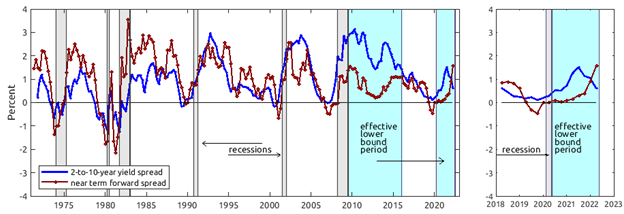

Martin Enlund ⚡️🦆🚁 on Twitter: "The near-term forward curve, highlighted by yield curve apologist as a much better recession indicator, is now heavily inverted. Yes, it sent a wrong signal in 1998,

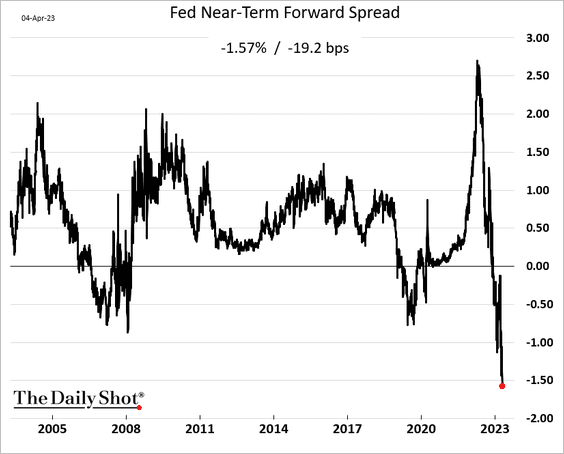

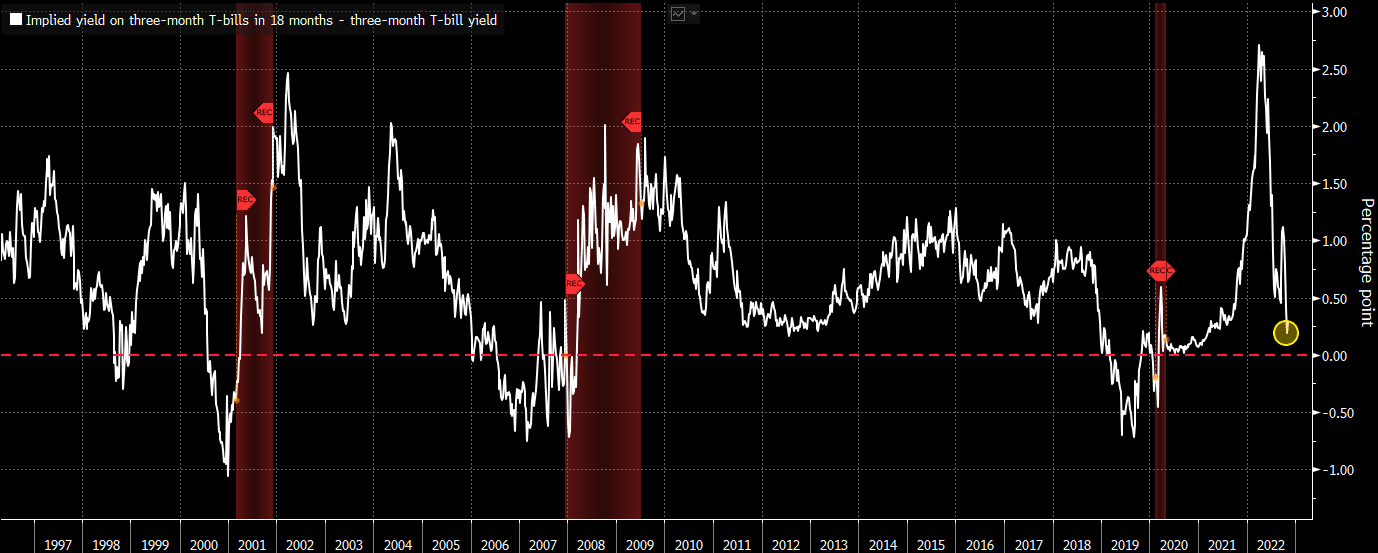

Liz Young on Twitter: "The near-term forward spread (i.e. 3mo yields now vs implied 3mo yields in 18m) is 157bps inverted. That implies a recession probability within the next 12 months of

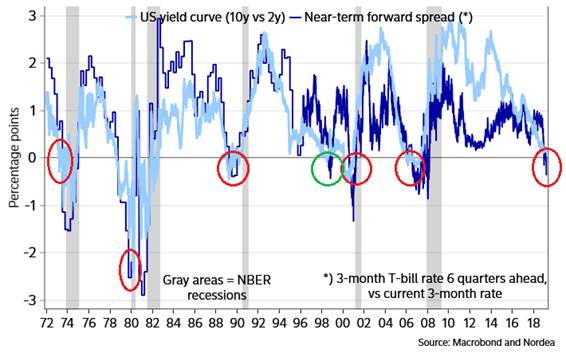

Liz Ann Sonders on Twitter: "Serious divergence between 10s2s yield spread (orange), which is nearly inverted, and Fed's near-term forward spread (blue), which is steepening markedly https://t.co/7oR1eEvBky" / Twitter

Martin Enlund ⚡️🦆🚁 on Twitter: "🌎🔥$USD: Well, well, well. Six months ago Fed officials & other economists said the flattening yield curve was wrong, that we had nothing to worry about, and